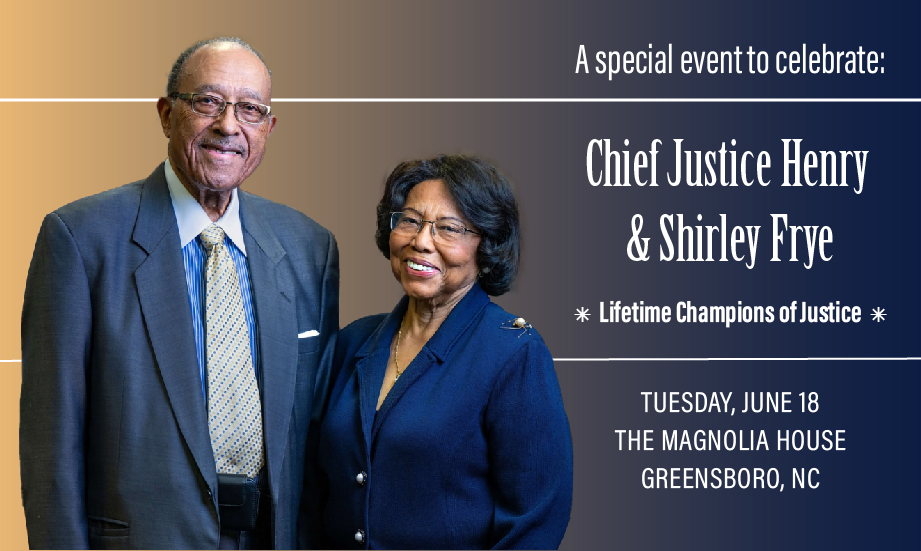

Join us for the 2024 Greensboro Champion of Justice Reception

Click here to learn more and become a sponsor

April is Second Chance Month

Help us fight for fair chances in NC

Help stop a harmful anti-immigrant bill

Contact lawmakers about HB10

Welcome to the North Carolina Justice Center

Our mission is to eliminate poverty in North Carolina by ensuring that every household in the state has access to the resources, services, and fair treatment it needs to achieve economic security.

News & Commentary

Upcoming Events

Honoring Chief Justice Henry and Shirley Frye

The Magnolia House, Greensboro

The 2024 Defenders of Justice

The Washington-Duke Inn, DurhamExplore Projects

A great resource to help educate North Carolina voters and policy leaders. The Center promotes advocacy for equitable solutions to real issues faced by the state.

Justice Circle

Justice Circle