North Carolina is missing out on a key tool used by 29 other states to strengthen hardworking families and boost local economies. A Working Family Tax Credit, based on the federal Earned Income Tax Credit (EITC), would provide a bottom-up tax cut to workers who earn low wages such as sales clerks, health care technicians and aides, military service members and early childhood teachers.

Each year more than 950,000 NC families could benefit from a Working Family Tax Credit including nearly 1.2 million children (See Appendix for County Level Data).

By providing additional dollars in the household to make ends meet, a tax credit targeted to working families is an evidence-based policy that can boost children’s developmental outcomes by supporting high quality early learning opportunities, as well as the health and stability of the household and their communities overall.1

Bottom-up tax cuts work by design

North Carolina has one of the highest rates of working poverty in the nation. One in eight North Carolina workers earns poverty-level wages which for a family of four is $25,750; well-below what it takes to make ends meet. 2

A Working Family Tax Credit in North Carolina that adopts the design of the federal EITC would allow for simplicity in administration of this tax change. It would also leverage the effective mechanisms of the federal policy that help families make ends meet, reduce poverty and keep people connected to the labor force.

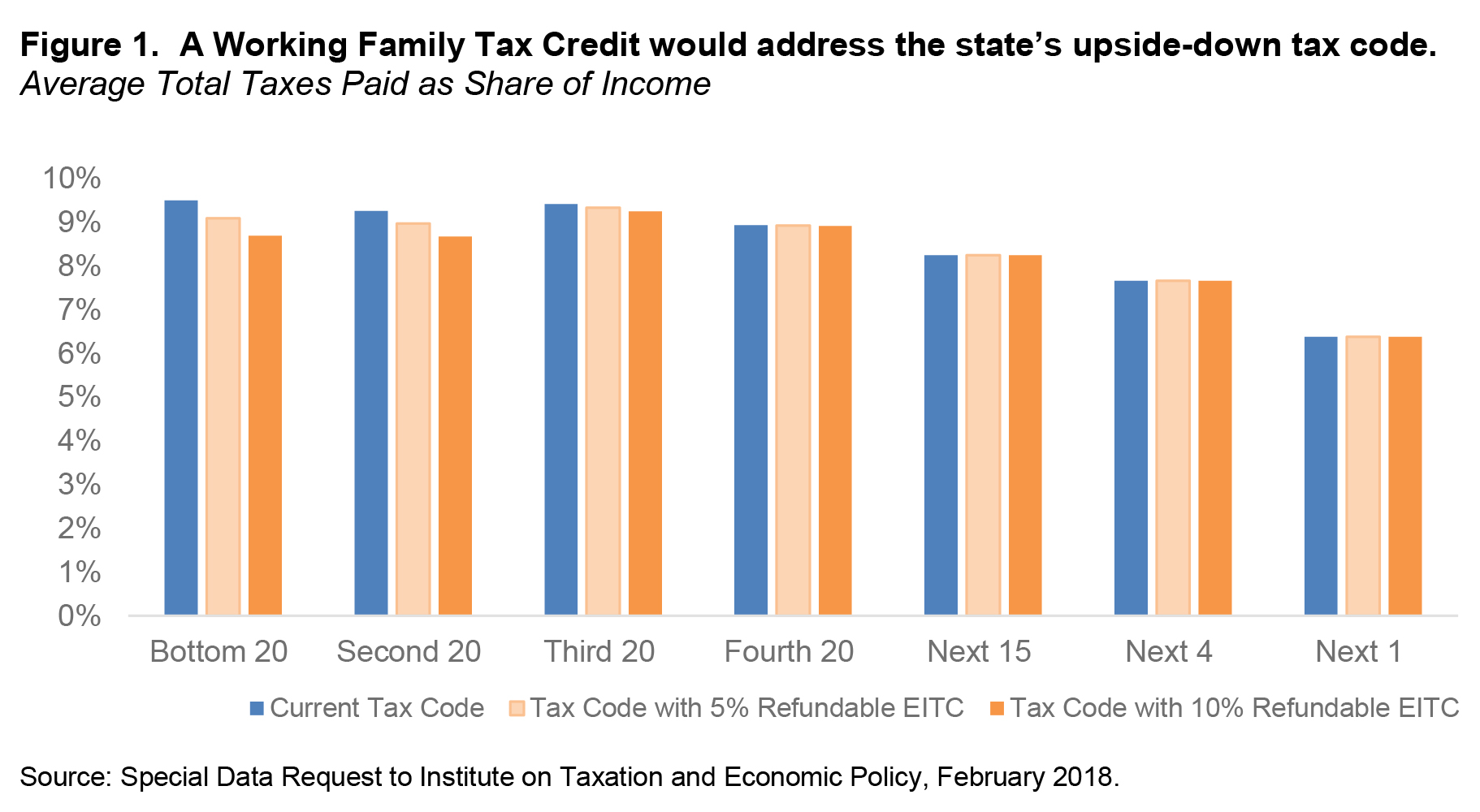

There are three key design features that help achieve these goals.3 First, the federal policy upon which the state credit could be based provides those with very low earnings an increased credit to encourage working more hours. It increases to the maximum amount allowed from very low levels of earnings and then declines gradually to zero with increased earnings. Second, it recognizes that the more children a family has, the higher their expenses are, thus varying the maximum credit based on family size. Finally, a Working Family Tax Credit in North Carolina would address the state’s upside-down tax code by offsetting some of the income low-income working families must dedicate to paying state and local taxes, particularly sales tax. North Carolina’s lowest income households, those in the bottom three-fifths, pay at or near 9.5 percent of their annual income in state and local taxes. The wealthiest North Carolinians — whose incomes put them in the top 1 percent of all households — pay under 6 percent of their income in state and local taxes.4

For the Working Family Tax Credit to effectively address the greater share of total income paid in state and local taxes by those with lower income, it is critical that the tax credit be refundable or based not just on income tax liability. Indeed, making sure that North Carolina taxpayers can receive the full value of the Working Families Tax Credit will ensure that those most in need receive the boost they need.5

A Working Family Tax Credit at 5 percent of the federal Earned Income Tax Credit represents a cost of $100 million or just 2.7 percent of the total revenue loss that will occur in the next year due to tax changes since 2013. Alternately, it is the same amount as could be raised by roughly a 0.5 percentage point increase in the corporate income tax rate. A tax credit at 10 percent would provide nearly double the value and provide a greater support to working families across the state.6

A Working Family Tax Credit is an effective tool to advance North Carolina’s goal of promoting the health and well-being and educational success of children and the stability and mobility of families.

Footnotes

- Williams, Erica and Samantha Waxman, March 2019. States can adopt or expand Earned Income Tax Credits to build a stronger future economy. Center on Budget and Policy Priorities: Washington, DC. Accessed at: https://www.cbpp.org/research/state-budget-and-tax/states-can-adopt-or-expand-earned-income-tax-credits-to-build-a

- Working Poor Families Project, Indicators and Data, Conditions of Working Families in North Carolina.

- Williams and Waxman, March 2019.

- Institute on Taxation and Economic Policy, 2018. Who Pays? With Special Data Request for Who Pays distribution with a state EITC at 5 percent of the federal credit.

- Davis, Aidan, September 2018. Rewarding Work through State EITCs in 2018. Institute on Taxation and Economic Policy, Washington, DC. Accessed at: https://itep.org/rewarding-work-through-state-earned-income-tax-credits-in-2018/

- Author’s calculation based on Internal Revenue Service data for North Carolina for Tax Year 2015, the last year data is available at the county level.

Justice Circle

Justice Circle