Important Notice

There is a change to North Carolina tax law that will provide relief to certain people assessed the NC Drug Tax

(along with other types of tax assessments).

N.C. Gen. Stat. 105-241.24, which was created in Senate Bill 174/ S.L. 2023-12, sets a 10-year statute of limitations for the enforcement of tax debts. The 10-year enforcement window starts once the tax becomes collectible. After the statute of limitations has expired, debt will be eliminated and the state can no longer seek enforcement of the debt through mechanisms such as garnishing wages, seizing property, or withdrawing money.

This law applies to people facing the NC Drug Tax.

If you or someone you know owes a drug tax debt that is more than 10 years old, you can confirm with the NC Department of Revenue that your debt has been forgiven – 1-919-707-7596

Read the Drug Tax Report

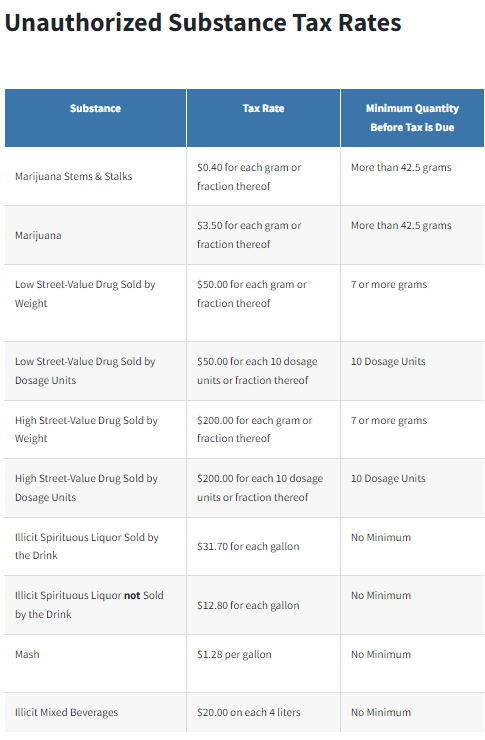

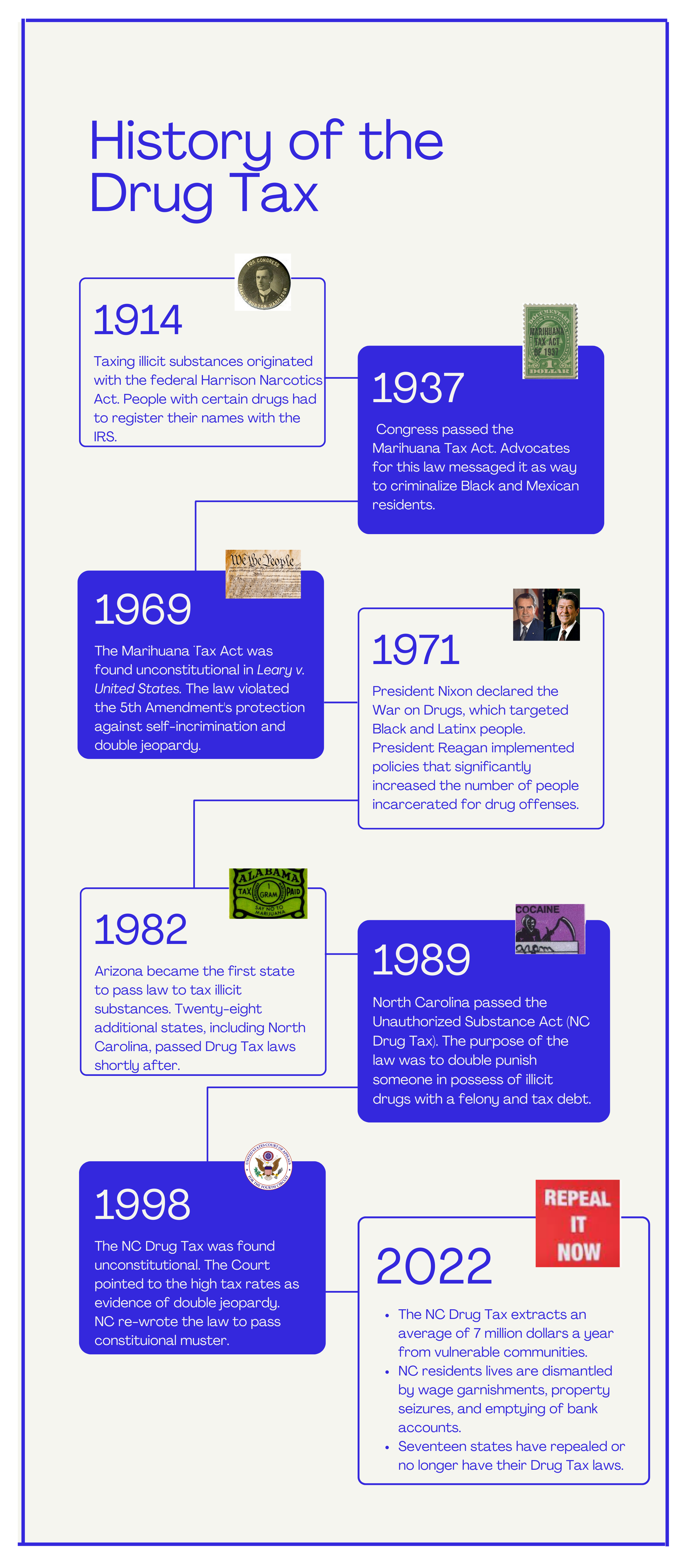

The NC Drug Tax

The Unauthorized Substances Tax (“NC Drug Tax”) is a tax on the possession of certain drugs. This law requires people in possession of certain amounts of a drug to purchase tax stamps and place them permanently on the substance. Almost no one, besides stamp collectors, purchase these stamps; most people either don’t know the stamps exist or they are wary about giving their information to the Department of Revenue (NC DOR). If a person does not purchase the required stamp and is found in possession of one of the specified substances, the law enforcement agency reports the failure to purchase stamps to the NC DOR. The NC DOR later assesses back taxes, penalties, and interest against the person. N.C. Gen. Stat. 105-241.24, which was created in Senate Bill 174/ S.L. 2023-12, sets a 10-year statute of limitations for the enforcement of tax debts. The 10-year enforcement window starts once the tax becomes collectible. After the statute of limitations has expired, debt will be eliminated and the state can no longer seek enforcement of the debt through mechanisms such as garnishing wages, seizing property, or withdrawing money.

Over four thousand people annually, on average, are exposed to thousands in back taxes, interest, and penalties. The average assessed drug tax is $8,872, but some end up owing millions.

Drug Tax Fact Sheet

WHY ABOLISH THE NC DRUG TAX:

A person can be assessed for the drug tax even if the associated criminal charges are dismissed or result in a “not guilty” verdict by the court.

The drug tax extracts millions from low-income communities and communities of color every year

The drug tax perversely incentivizes over-policing vulnerable communities because 75% of the money collected is given to the law enforcement agency that initiated the investigation that led to the tax assessment.

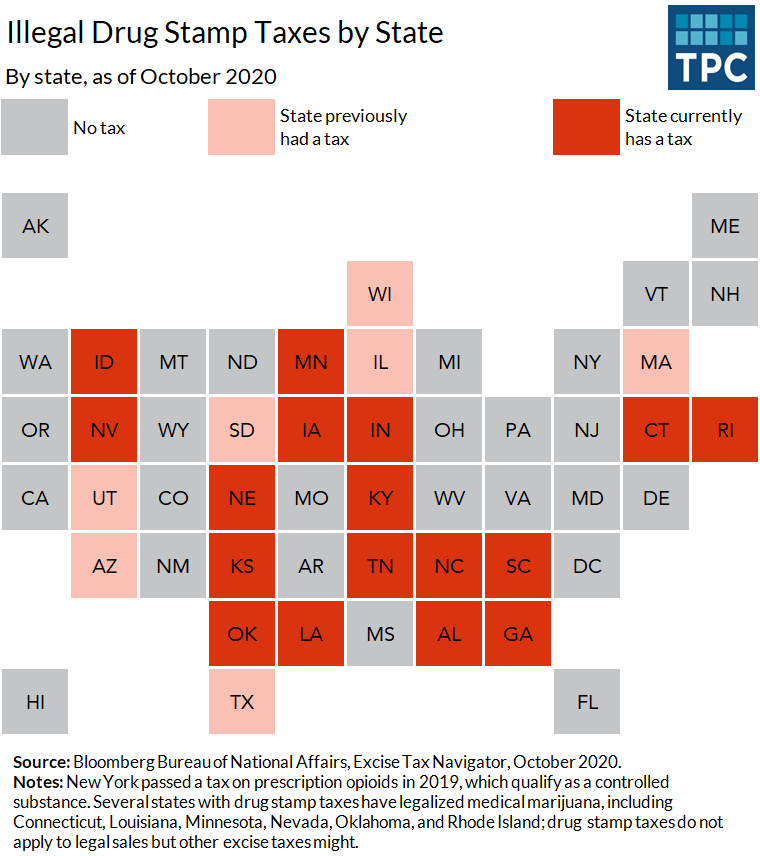

Thirty-three states and the federal have deemed drug taxes unnecessary, unjust, or unconstitutional

Hear from people affected by the Drug Tax

RESOURCES:

- https://www.ncdor.gov/taxes-forms/other-taxes-and-fees/unauthorized-substances/unauthorized-substances-tax-return

- https://ncpolicywatch.com/2021/06/28/the-nc-drug-tax-is-designed-to-ensnare-and-penalize-people-especially-those-of-color/

- https://www.cbs17.com/news/north-carolina-news/nc-law-says-you-must-pay-a-tax-on-your-illegal-drugs-but-that-wont-make-them-legal/

- https://www.wral.com/news/local/story/6833320/

- https://www.carolinajournal.com/opinion-article/no-kidding-north-carolina-taxes-illegal-drugs/

- https://www.carolinajournal.com/video/jlfs-brenee-goforth-discusses-n-c-illegal-drug-tax/

Justice Circle

Justice Circle