Statistics on Medical Debt in North Carolina

- Eight percent of our state’s population had medical debt in collections in 2023. That figure climbs to 10 percent among communities of color.1

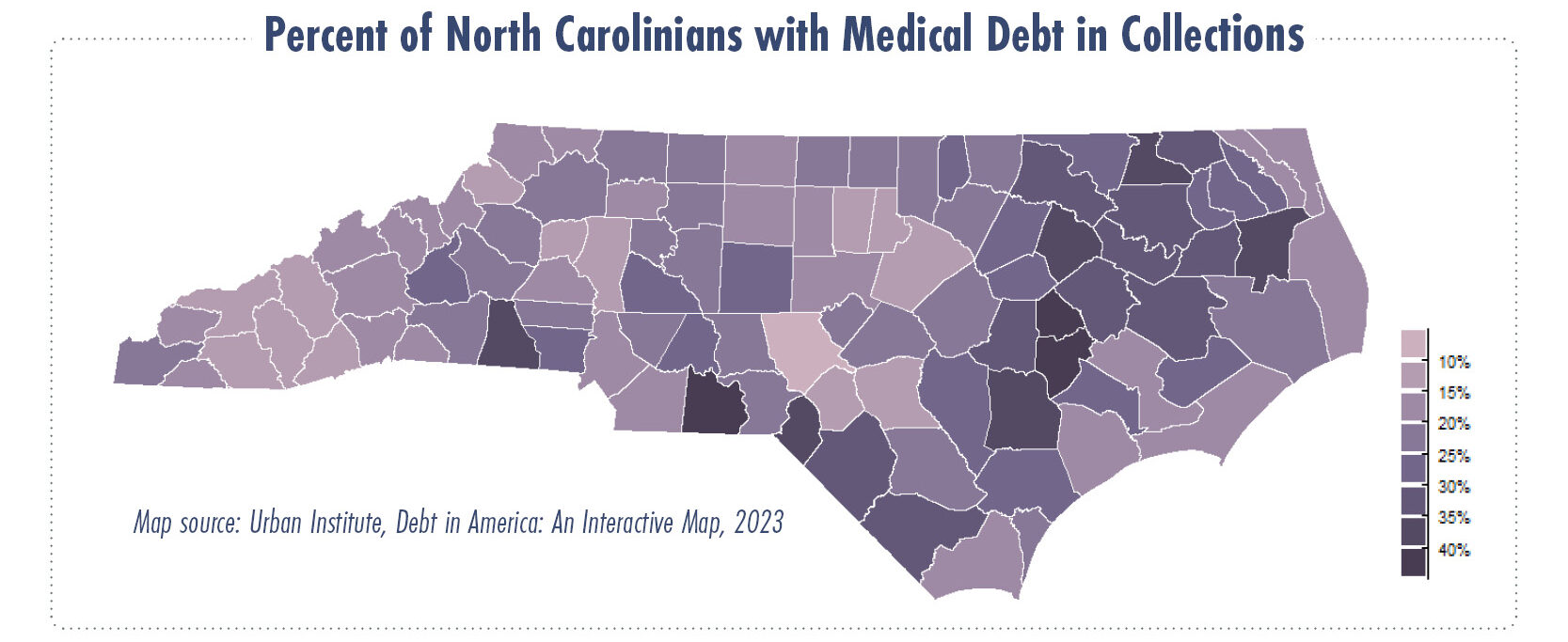

- North Carolina has the 4th highest percentage of people with medical debt in collections among all states, with some counties exceeding 40 percent in collections.

- North Carolina has the 20th highest hospital prices in the country despite wages only ranking 40th.2

What’s Being Done to Alleviate Medical Debt

The Governor’s Office and the NC Department of Health and Human Services have initiated a groundbreaking medical debt relief incentive program that will relieve medical debt for two million North Carolinians, cap interest rates on medical debt, provide generous discounts on hospital prices to families with certain incomes, automatically enroll people into financial assistance, and prohibit selling debt to collectors. All 99 acute care hospitals around the state have decided to participate in the program.

Read a summary of what the NCDHHS program will do.

Get Help with Medical Debt

- Get relief from hospital bills: We are proud to partner with Dollar For, a national nonprofit that crushes medical bills by helping patients access charity care. This direct service program has leveraged technology to help 17,079 patients apply for financial assistance. Since 2021, Dollar For has secured $60,012,054 in medical debt relief. See if you qualify by using Dollar For’s financial eligibility tool here.

- Learn what to do when facing a bill you can’t afford: If you’re facing medical debt and unsure of how to pay, you’re not alone! Here are some general tips to follow if you are unable to pay a medical bill.

Take Action Today

Health care patients across our state need peace of mind that they can heal without medical debt. You can help us provide that peace of mind for everyday North Carolinians by signing up to participate in our medical debt campaign or by sharing your own personal story. Your support will be especially influential in inspiring hospital leaders and N.C. lawmakers to make sure patients receive financial assistance at hospitals, quality service without hidden fees, and protections against extraordinary medical debt collections.

Please consider working with our team to take action or become a storyteller advocate. You can start by filling out this form or by contacting our Health Policy Advocate, Rebecca Cerese, at rebecca@ncjustice.org.

1 Urban Institute. Debt in America: An Interactive Map. Available at https://apps.urban.org/features/debt-interactive-map

2 The study computed the ratio of prices paid by private insurers with those paid by Medicare. North Carolina’s relative price was 266 percent of Medicare; the national average ratio was 224 percent. Christopher M. Whaley et al., Prices Paid to Hospitals by Private Health Plans: Findings from Round 4 of an Employer-Led Transparency Initiative. RAND Corporation, 2022.

Justice Circle

Justice Circle