Much has been made of the direct cash payments included in the CARES Act passed by Congress to provide relief during the COVID-19 pandemic. Providing emergency aid was the right move, but this step alone won’t solve the financial challenges facing North Carolina families or pull the state out of a rapidly deepening economic hole.

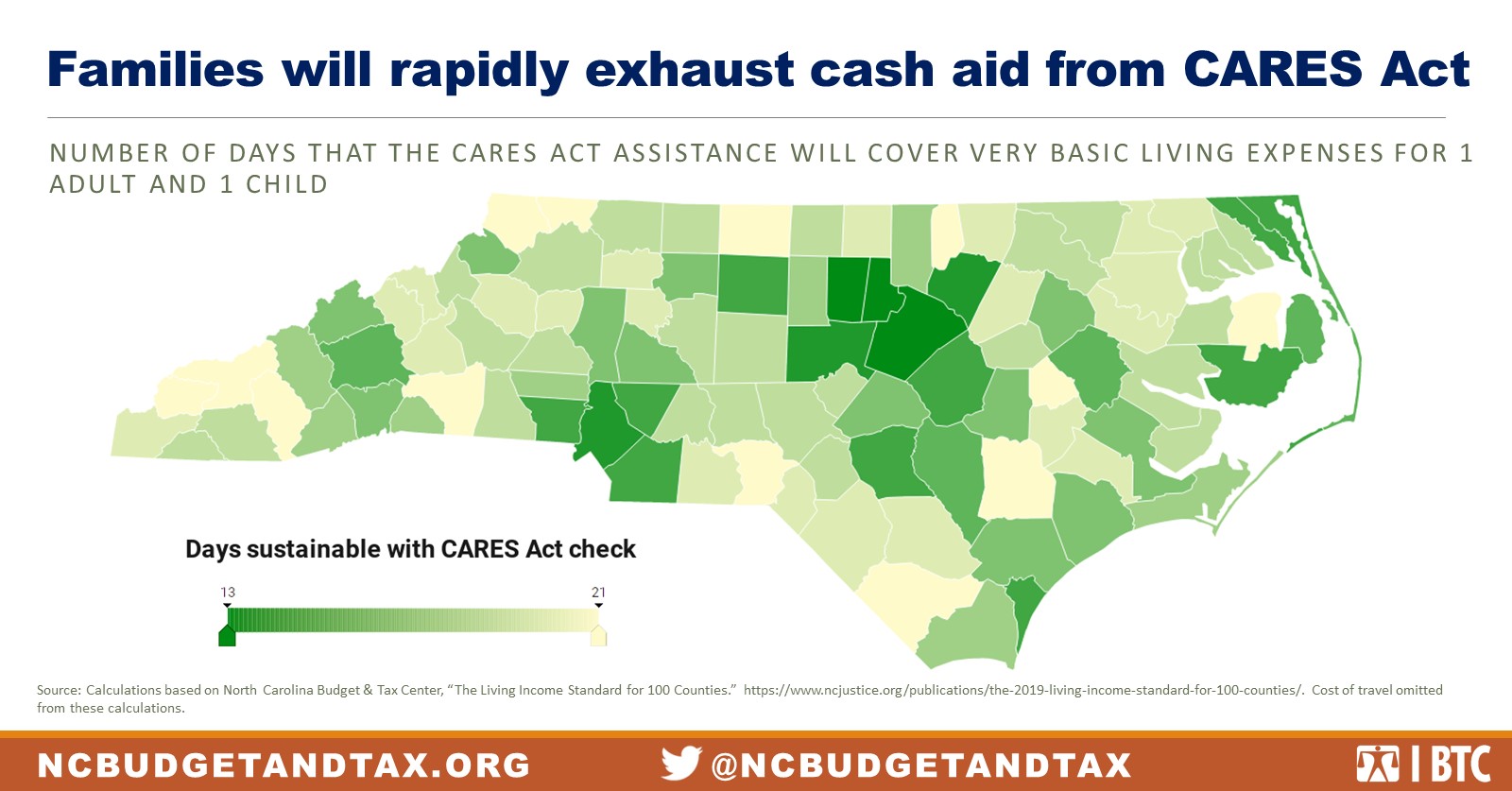

The first and largest issue with these cash payments is they are simply too small to get families through this time of crisis. As shown in Figure 1, the cash aid included in the CARES Act will only cover the cost of basic living expenses for a few weeks, grossly inadequate in the face of a pandemic likely to last months. Compounding that fundamental issue, using the tax system as the infrastructure for distributing the aid risks delaying aid to many people in the most need or bypassing the most economically vulnerable North Carolinians altogether. For several reasons discussed in more detail below, issuing the aid as a tax rebate makes it a virtual certainty that checks will take longer to reach a lot of North Carolina’s poorest residents, and many may not receive a check at all.

The COVID-19 outbreak highlights how vital it is to have effective ways to support people facing a financial crisis beyond their control and how vulnerable our entire economy is when that kind of system is not in place.

Cash payments won’t meet families’ needs for long

Direct cash payments are the single fastest way for government to support families in a time of crisis, whether that be a pandemic, illness, loss of a job, or other unforeseen event. The CARES Act creates a $1,200 one-time payment for all U.S. residents, or $2,400 for married couples, with an additional $500 per child dependent, which phases out for high income people.

That’s certainly nothing to sneeze at, but it won’t address the long-term economic fallout of the COVID-19 outbreak — particularly given that roughly 2 out of every 5 households in North Carolina can’t survive above the poverty line for three months without income, and many of those families are the low-income workers who were the first to lose their jobs to the COVID-19 crisis. Based on our most recent Living Income Standard report, the direct aid provided by the CARES Act will pay for the basic necessities for roughly two to four weeks.

As can be seen in Figure 1, families will burn through the aid faster in the more expensive urban parts of North Carolina. How long the aid will last also depends on family size and how travel and childcare costs change during this time. Regardless of the details, many families will certainly use up the cash aid and need additional support before this crisis is over.

Direct payments to people in need are the best economic stimulus, but these checks won’t pull us out of the COVID-19 recession

Putting money in people’s pockets is the best way to stabilize a quaking economy. As we saw during the Great Recession, direct payments to individuals had a significantly larger economic return on investment than tax cuts. Thankfully, these cash payments are not the only provision of the CARES Act that puts money in the pockets of people and families. The package boosts the amount and duration of Unemployment Insurance payments for people who lose jobs or hours due to the outbreak. Particularly in states like North Carolina where existing Unemployment Insurance benefits are grossly inadequate, the UI provisions will prove far more important than one-time checks for many families.

That said, we are confronted with a sobering reality. The CARES Act will not pull us out of a downturn that is getting worse by the day and that will almost certainly end up being one of the most severe economic collapses in American history. Hundreds of thousands of North Carolinians filed for unemployment in just the first few weeks of the outbreak in the state starting in mid-March. The rebate aid is really about immediate financial survival, so leaders from the federal to the local level should be setting up the economic stimulus that we will need to actually recover and avert a prolonged recession.

Using the tax system to deliver relief is a huge problem

In a replay of how aid checks were dispensed during the Great Recession, the CARES Act reveals giant holes in how we get cash to people in desperate need. Without federal, state, and local policy action, many of the North Carolinians who need aid most urgently will be the last to get it or won’t get it at all.

A recent analysis by the Institute on Taxation and Economic Policy found that North Carolinians in the bottom 40 percent of the income distribution will receive less than their proportional share of the cash payments.

• Very low-income people not required to file tax returns

The one-time payments for individuals and families is technically a tax rebate, so many of the poorest North Carolinians are likely to miss out. The rebate is tied to tax filings in the past two years, and many of North Carolina’s least affluent people may be ineligible to receive the aid because people with incomes below the federal standard deduction are not required to file a tax return. That means that a lot of people with disabilities and very low-income workers may not receive assistance from the CARES Act. Moreover, immigrant taxpayers who file with an ITIN, or for whom no member of the household has a Social Security number, are ineligible for the cash payment. This provision alone excludes at least 300,000 adults and children across North Carolina.

These holes in the system mean many families and communities who need stabilizing aid the most are not currently in line to receive it.

We saw this problem in 2008 when millions of people had to submit tax filings just to receive stimulus checks, which caused delays and confusion, and some people missed out. Experts believe the Trump Administration can easily overcome this barrier, but that action has not happened yet. Under pressure from Congressional Democrats, the Treasury Department did announce all Social Security recipients would get the checks, but that doesn’t address the full scope of the problem. Because the Trump Administration has yet to use its authority to overcome these problems, state and local leaders need to step up and ensure that as many North Carolinians as possible receive these cash payments as fast as possible. In some instances, this may entail using existing infrastructure for delivering public benefits.

• Homeless and unbanked people

A lot of North Carolina’s most vulnerable people will take longer to get their aid, and many may never get it at all. Tax filers who provided bank account information in their 2019 filings will have the rebate directly deposited just like a normal refund, and checks will be mailed to everyone else who is eligible. First, this will mean North Carolina’s lowest income people who don’t have bank accounts will be the last to get their assistance, and many of them work in the service jobs already disappearing in the first phases of the outbreak.

Next, it creates a huge problem for people with unstable housing or for homeless North Carolinians. If someone has moved since filing their tax returns or lacks stable housing altogether, the checks may never reach them or at best will be even more delayed. State and local authorities need to be moving now to figure out how checks will actually get to many of the people who need them in the most urgent way.

• College students and their families

If a college student is claimed as a dependent, their parents will receive the $500 additional aid for a child. That means that college students whose parents cover at least half of their expenses will receive nothing directly and also that the whole family unit will lose out on the $700 difference between the child rebate and the full $1,200 adult rebate. Here again, relying on the tax status of individuals undermines our ability to put money in the pockets of people who need it.

Prevent scammers, cheats, and predatory lenders from having a field day

It’s a sad fact of life that whenever poor and economically vulnerable people have any money in their pockets that scammers, cheats, and unscrupulous lenders will try to steal it. Unless state and federal elected leaders and law enforcement step up fast, the COVID-19 checks won’t help all the people who need them the most.

North Carolina has some of the best laws in the country against predatory lending and scams that target state residents and consumers who already have lost jobs, have little savings, and are struggling to survive. Similar to the Great Recession, state and federal policymakers and regulators may need to take quick and decisive regulatory and legislative steps to help ensure that predatory service providers and/or lenders are unable to take advantage of people who are receiving federal aid checks.

Predatory lenders are not the only threat out there. For example, we’ve already seen scammers trying to get bank account information by posing as the IRS and even some companies trying to siphon off their employees’ COVID-19 aid. (Check out this fact sheet if you’re wondering about employees’ rights in these uncertain times.) Just as with predatory lending, rigorous enforcement along with potential state and federal legislative fixes will be required to prevent these kinds of abuses.

Patch the holes and then build a better boat

All problems with the cash aid in the CARES Act ultimately flow from the same source. We lack the tools to deliver cash payments to individuals who fall on hard times, a problem only thrown into greater relief by the COVID-19 outbreak. Instead of having a way to deliver adequate assistance to everyone who needs it, lawmakers had to hit the panic button and jury rig our tax system to execute a job that it was never designed to do. Federal, state, and local leaders can solve some of these problems this time around by using other programs, like existing anti-poverty programs, to deliver the payments, but that won’t ultimately fix the long-term issue. Lots of developed countries have figured out better ways to support citizens experiencing personal crisis, and such infrastructure becomes even more essential in times of national emergency.

Justice Circle

Justice Circle