The conference budget released by the NC General Assembly on Monday night puts business interests and politics ahead of people while bringing North Carolina to a new low in terms of spending as a share the economy (with the exception of the prior year, FY 2020-2021, when prior state spending commitments were maintained and no legislative budget was enacted).

This plan — which was crafted by General Assembly leadership and legislators appointed to the conference committee with input from the Governor’s office, all behind closed doors — will lock in changes to the tax code, including elimination of the corporate income tax and reduction of the personal income tax rate, that will permanently reduce revenue that the state has available to pay for every area of the budget. It will overwhelmingly benefit the wealthiest North Carolinians as well as out-of-state corporations. The plan also kicks the can down the road yet again for Medicaid expansion, instead creating a legislative study committee on the topic, and flies in the face of more than two decades of litigation urging the state to comply with the state constitution and fund the baseline funding to provide each child with a sound, basic education.

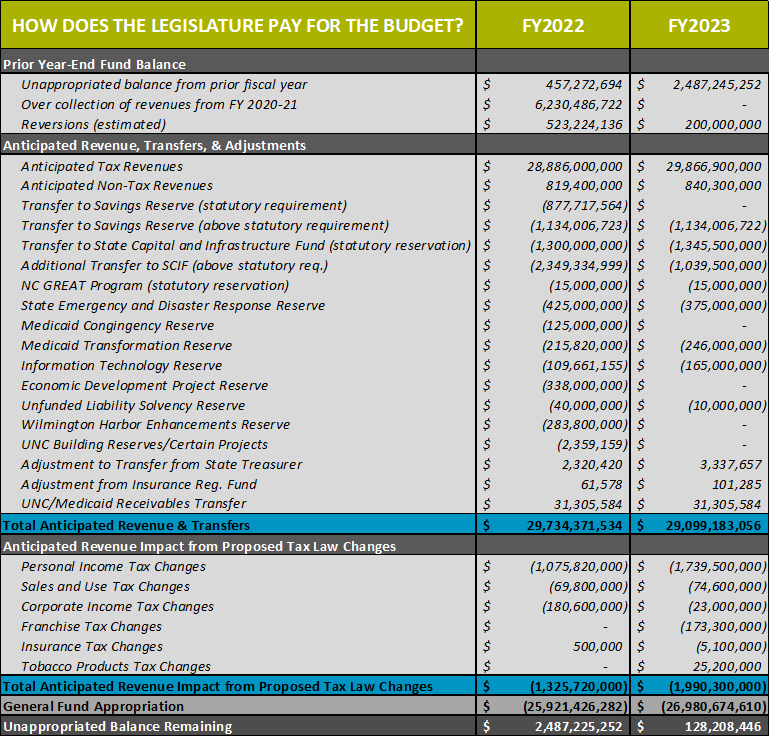

The conference budget outlines proposed state spending through the remainder of the biennium, which began 5 months ago in July. The budget will commit the state to spending marginally above the arbitrary spending limits that House and Senate leadership agreed to at the outset of the budget process – spending $25.9 billion instead of the $25.7 billion previously agreed upon in June.

Once enacted, this conference budget will become the final budget that the state will operate on for two years, but with additional changes to be considered next year for the second year of the budget.

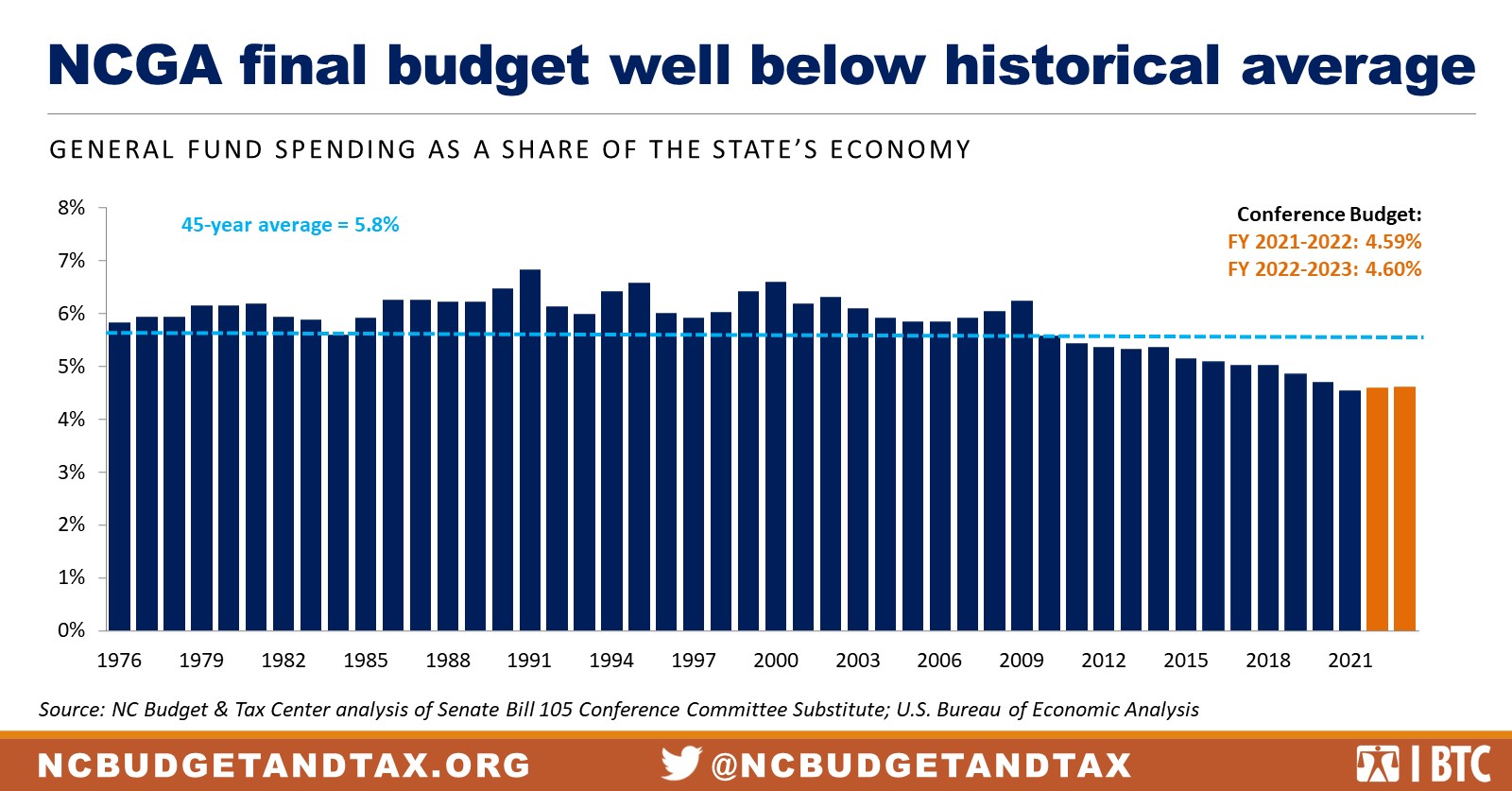

A new low point for state spending based on enacted budgets

The conference budget outlines how the General Assembly proposes to spend $25.9 billion in Fiscal Year (FY) 2021-2022 and $27.0 billion in FY 2022-2023 in General Funds. Similar to the House and Senate proposed budgets earlier this year, the conference budget will bring North Carolina’s investments to a 45-year low of 4.59 percent of the state’s economy in the first year and 4.60 percent in the second year. The only exception is in FY 2020-2021, which was the second year of operating on a continuation budget plus piecemeal budgets. This budget will continue operating the state on funding levels that fall $7 billion short of the 45-year average spending as a share of the economy (as represented by the dotted blue line in the chart).

Major tax changes ensure even greater austerity in the future

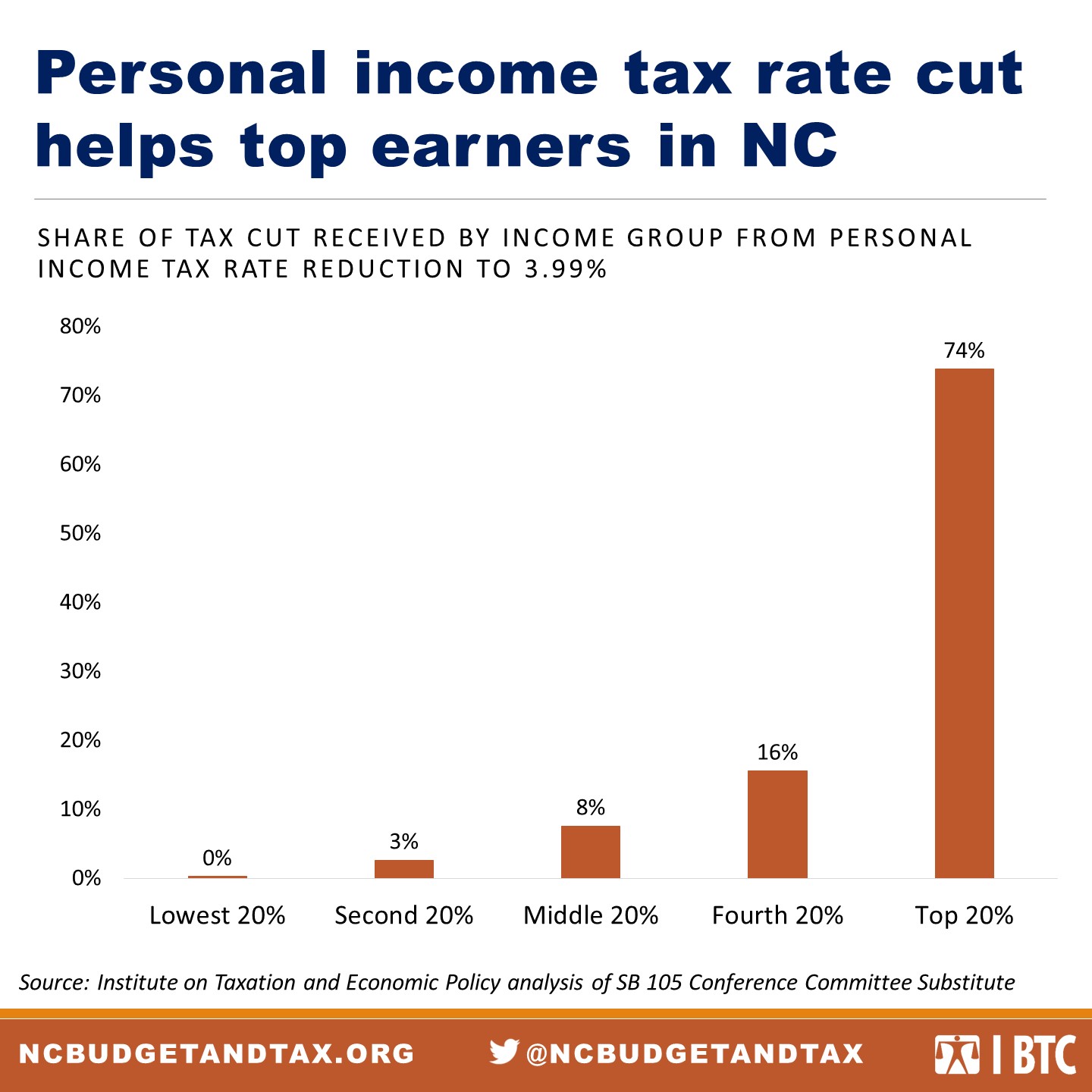

As first seen in the Senate plan released in June, legislative leaders and the Governor have agreed to eliminating the corporate income tax, paid by corporations on their profits and thereby largely benefiting out-of-state corporations, by the end of the decade. The final budget will also reduce the personal income tax rate, which will provide the greatest benefit to the wealthiest North Carolinians because of its flat structure.

This permanent upheaval of the state’s tax code will eliminate $8 billion in state revenue annually once fully implemented, ensuring that the state will not only fail to keep up with what people need but also will have to make cuts across areas currently funded by the budget.

The personal income tax reduction, which would reduce the flat rate from the current 5.25 percent to 3.99 percent over 6 years, will overwhelmingly benefit the wealthiest North Carolinians. When fully implemented in 2027, 74 percent of the cut will go to the wealthiest North Carolinians whose incomes are greater than $110,00, while low- and middle-income North Carolinians will experience little to no benefit.

Billions transferred to reserves for future capital and savings

Not included in the topline budget figures are the billions in funds transferred to a variety of General Fund reserves, namely the State Capital and Infrastructure Fund (SCIF) and Savings Reserve, better known as the “Rainy Day” fund. By the end of the biennium, the SCIF will grow by $6 billion while the savings reserve will see an additional $3.2 billion added to the current balance of nearly $2 billion.

This means that all of the current $9 billion in unreserved cash on hand is soon to be locked away for future uses rather than being thoughtfully used now in order to meet the many needs across the state that have yet to be addressed through any action by state lawmakers.

A final budget that doesn’t prioritize North Carolinians

This final budget is the culmination of months of closed-door negotiations and political calculations, which followed two legislative budget proposals that were generated in the same way. Since the legislative session began in January, there has never been a public forum whereby lawmakers sought input from North Carolinians, let alone offered transparency as to how decisions were made.

This budget process demonstrates a successful effort to advance ideologies that take money away from public supports that help each and every North Carolinian – Black, brown, indigenous, and white – and into the pockets of wealthy individuals and corporations.

The erosion of the state’s tax code, a long-time goal of legislative leaders, takes a major plunge in this plan and with it the exacerbation of an already inequitable system that is sure to worsen as the state scrambles for revenue and looks to raising other, more inequitable taxes as the supposed solution.

Simply put, North Carolina will be worse off as a result of this budget.

Many have and will continue to celebrate the small successes included in this budget. These investments are primarily funded with one-time federal money that won’t be sustained in future years and demonstrate a lack of commitment to a long-term vision for a state that can afford abundant opportunity.

Make no mistake: If we want to create a more equitable, more resilient, and brighter future where all needs are met, we must reject the current zero-sum strategy – where prosperity for some can only come at the expense of others – that does not help us move forward and, in fact, holds us back from the vision we collectively want for our state.

Suzy Khachaturyan is a Policy Analyst at the Budget & Tax Center, a project of the NC Justice Center.

Justice Circle

Justice Circle