The state budget represents one of the single most important pieces of policy that legislators enact every two years as it allocates state tax dollars, fees, and federal funds to priorities for families and communities across the state.

There are a number of ways to assess whether a budget proposal is fulfilling its purpose of funding the public good. These include looking over time at investments as a share of personal income to assess whether public investments are maintained at a steady level even as the economy grows or documenting how spending matches to needs in communities.

Oftentimes, discussion of the spending levels proposed in specific areas focus on the year over year change in spending from the base budget. While this shows that policymakers are recognizing that spending year over year must grow with the rising costs of delivering goods and services and the growth of enrollment, this baseline does not provide information about whether the investment is sufficient to maintain current service levels in light of those two fundamental trends. It also doesn’t tell us if the investment is making up ground that could have been lost due to an economic downturn or decisions to hold spending down across a longer time horizon.

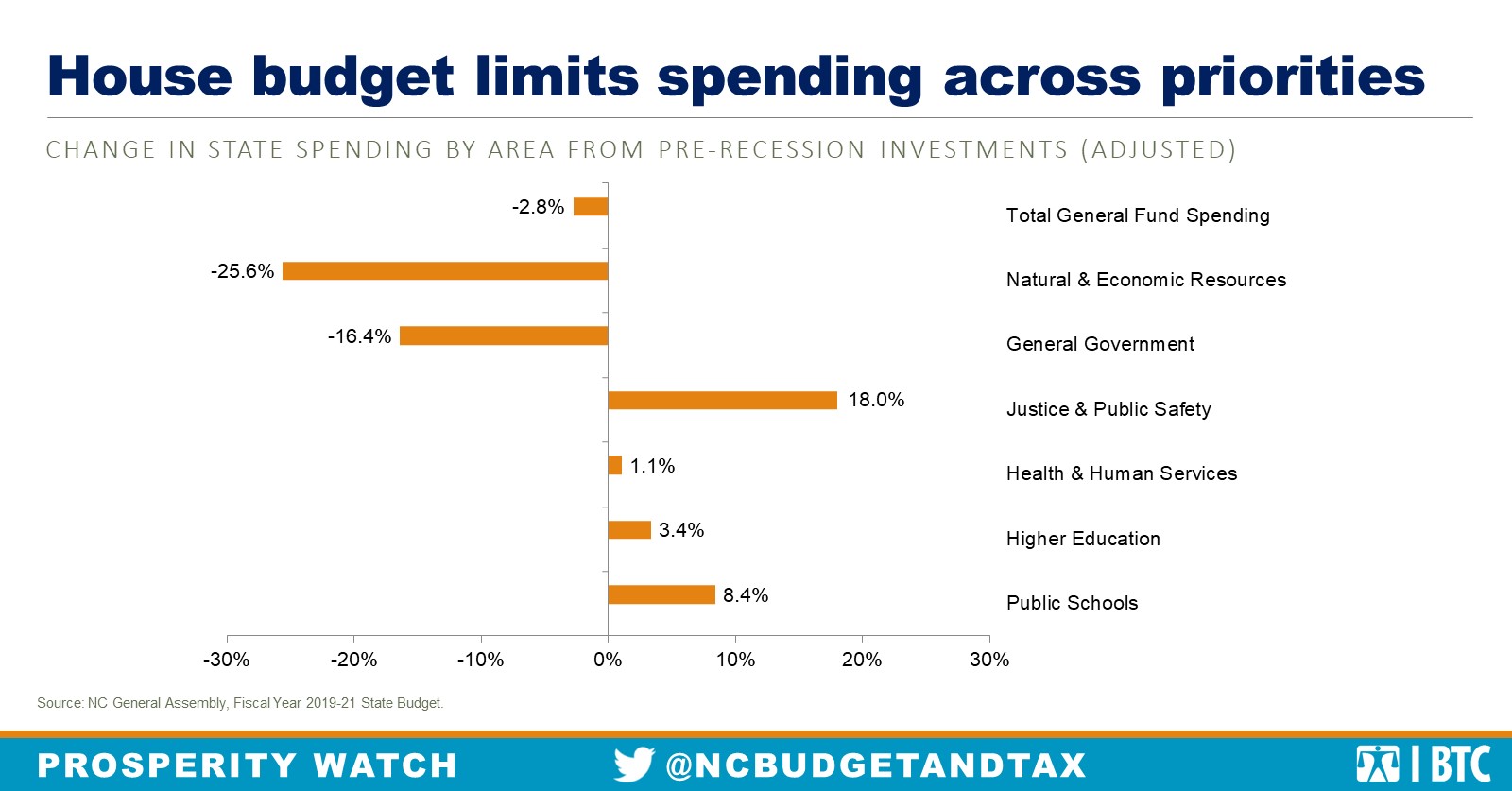

A historic look at the House budget proposal relative to the pre-Recession fiscal year shows just where state policymakers have prioritized investments. Importantly, though, this historic look doesn’t take into account whether dollars have gone to specific items. As an example, in the area of public schools, the House budget invests nearly all of the year-over-year increase into salaries and benefits, leaving just $42 million in FY 19-20 and $62 million in FY 20-21 to expand services for students.

The lack of public investments in the economic recovery will present challenges for our state’s long-term economic health. As researchers have shown, public investments in education, infrastructure, and the health and well-being of families support stronger economic outcomes as measured by lower poverty rates and income inequality and higher wages.

Justice Circle

Justice Circle