North Carolina needs to provide adequate wage replacement and recognize the time it takes to find a job so the state can keep workers in the labor force and sustain the economy

North Carolinians who have lost their jobs through no fault of their own stand less chance of collecting unemployment insurance or — if they do — replacing prior wages than before changes were made to the system in 2013. For jobless workers today, the additional challenge of too few weeks of support means that moving out of the labor force is more likely than moving into employment.

At the same time, unemployment insurance (UI) is doing less to stabilize the budgets of those temporarily unemployed through no fault of their own and the communities where they live. This is particularly true for rural communities and places, both urban and rural, where unemployment remains concentrated. For these communities, the stabilizing force of UI to keep people connected to finding work and to keep dollars circulating in local businesses has faltered.

And yet, North Carolina’s Unemployment Insurance Trust Fund has reached solvency standards recognized by economists as indicating that the funding of the program in good times has reached sufficient levels to pay out benefits in a downturn. While North Carolina may be positioned well for the next downturn in this regard, the failure to provide adequate stabilization to those who have lost their jobs and to the employers who require workers could undermine the ability of the system to perform on the benefit side when the next significant economic disruption occurs.

By key measures of North Carolina’s unemployment insurance system, performance is lagging the need

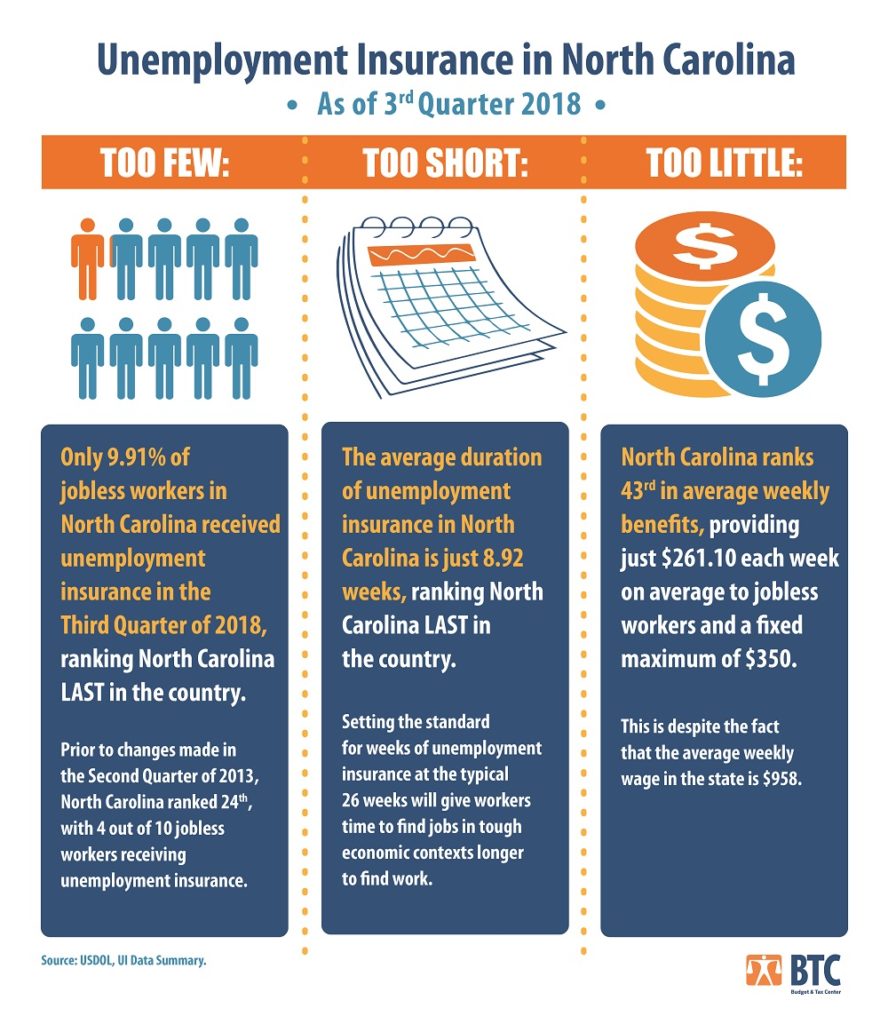

North Carolina’s unemployment insurance system is serving too few jobless workers for too short a time and providing too little in wage replacement (See Figure 1). 1

Too Few

Only 9.91 percent of jobless workers in North Carolina received unemployment insurance in the Fourth Quarter of 2018, ranking North Carolina last in the country. Prior to changes made in the Second Quarter of 2013, North Carolina ranked 24th, with 4 out of 10 jobless workers receiving unemployment insurance. North Carolina now has the third highest rate of benefit exhaustion in the country, with half of those receiving unemployment insurance losing benefits before they find a job. The low level of reach by the system is in part due to exhaustions and in part due to changes in who is eligible and how they apply. Changes to ensure that those seeking unemployment insurance have multiple venues to apply and that those who have lost their job due to relocation, domestic violence, or care of sick family members receive support will help address these issues, as will fixing the duration of unemployment insurance overall.

Too Short

The average duration of unemployment insurance in North Carolina is just 8.92 weeks, ranking North Carolina last in the country. This short duration is, in part, a function of the state’s arbitrary sliding scale that ties the number of weeks of benefits to the state unemployment rate. Even as the state unemployment rate falls, many counties have more jobless workers than job openings. Setting the standard for weeks of unemployment insurance at the typical 26 weeks will give workers the time they need to seek short-term credentials for new careers or the time to find jobs in tough economic contexts when it takes longer to find work.

Too Little

North Carolina provides just $261.10 each week on average to jobless workers and a fixed maximum of $350. The state is replacing just 32 cents for every $1 in lost income, circulating far fewer dollars in the economy than recommended by economists, who typically seek a replacement rate of at least 50 percent. Establishing a formula that is based on the highest quarter of earnings and ties the maximum benefit amount to wages in the economy will better ensure that North Carolina’s system is serving its wage replacement goal.

North Carolina employers and the broader economy benefit from an effective unemployment insurance system

The unemployment insurance system’s purpose is to provide temporary, partial wage replacement at a level that staves off a drop in consumer spending that would destabilize the broader economy. By failing to design the system to cover a significant share of those who have lost their jobs and to provide payment that is meaningful relative to the wages earned through previous work, the system is not as effective as it should be at serving this broader goal.

The less that unemployment insurance helps jobless men and women meet basic needs and stay attached to the labor market, the more that it erodes purchases of goods and services. An inadequate unemployment insurance system doesn’t just hurt the jobless; it hurts the businesses where they would shop and, by extension, the economy as a whole.

In today’s labor market, there are still too few jobs for those who want to work. Two particularly damaging phenomena have resulted: persistently low labor force participation and the failure of wage growth to accelerate.

- Labor Force Participation: North Carolina’s labor force participation remains below pre-Recession levels at 61.1 percent in March 2019, compared to 65.3 percent in December 2007.2 Low labor-force participation in the current context is largely attributed to too few jobs in the labor market.

- Slow Wage Growth: North Carolina’s wage growth has been slow to recover to pre-Recession levels for the median worker in the state. Indeed, over the period from 2007 to 2018, the median worker’s hourly wages grew by just 4 percent.3 Over that same period, the cost of housing grew by more than 20 percent and child care costs by more than 60 percent.4 In large part, this is due to the greater demand for work than there are job openings, which has held wages down (although other longer-term trends are also at play here).

Taken together, these outcomes have a depressing effect on the broader potential for economic growth and in the long-term value placed on work. In combination with too few dollars circulating in the economy, there is a dampening effect on demand for goods and services and job creation that cannot be overcome by the promise of trickle-down tax cuts. Instead, ensuring that working people who lose their jobs through no fault of their own can stabilize their households and continue to seek job opportunities is critical to a strong North Carolina economy.

An unemployment insurance system — designed to reach those who need support with adequate wage replacement and time to seek new employment — is a critical antidote to the downward spiral that can occur from a job loss. It is important to fix the system before the next downturn comes to North Carolina so that workers, businesses, and the entire state economy are positioned to recover quickly and equitably.

Footnotes

- All data taken from the U.S. Department of Labor Unemployment Insurance Data Summary for Quarter 4 of 2018 and Quarter 2 of 2013. Accessed at: https://oui.doleta.gov/unemploy/data_summary/DataSummTable.asp

- https://www.ncjustice.org/projects/budget-and-tax-center/economy/labor-market-in-n-c/

- Economic Policy Institute Analysis of Current Population Survey, Median Hourly Wage.

- https://www.ncjustice.org/publications/health-coverage-or-food-on-the-table/

Justice Circle

Justice Circle