Property taxes are the largest and most important revenue source for local governments in North Carolina. The funds generated from property taxes pay for vital services like public education and safety. Unfortunately, property taxes can contribute to economic inequities because low-income people pay a larger percentage of their earnings on housing than wealthier homeowners do. North Carolina needs to update its property tax relief programs to more effectively ease the burden on low-income families while protecting the most vital source of revenue for local governments.

How are property taxes calculated?

Home Value/100 * (county rate + city rate) – Property Tax Relief = Property Tax Bill

A homeowners’ property tax bill is calculated by multiplying the assessed value of a property by the combined city and county tax rate.1 In North Carolina, there is no state property tax. Counties collect the largest share of property tax revenue. All but one municipality2 also levies its own property tax, but at lower rates than counties.3 Homeowners who apply for and receive property tax relief can lower their property tax bill according to the guidelines of the program.4 Eligibility guidelines for North Carolina’s property tax relief programs are outlined below.

Property tax scenarios5

The following scenarios demonstrate how property tax bills are calculated and how the percent of income one pays in property taxes depends on their income, the value of their home, and their property tax rate. The last column shows how changes in income affect a family’s ability to afford property taxes. When a family member gets laid off or works fewer hours to take care of a loved one, their property tax bill is unchanged and eats up a larger percentage of a family’s income. This increases the risk of default and foreclosure. Similar results could occur when home values rise or property tax rates increase even if income is unchanged.

How have property taxes changed over time?

The average effective property tax rate in North Carolina (.86%) is significantly lower than the national average (1.08%).9 Property tax rates fluctuate in response to changes in home values, the size of the tax base, and local revenue needs. Over the past five years, property tax rates in North Carolina went up in 52 counties, down in 23, and stayed the same in 25, resulting in an average increase of about 4.8 percent.10

North Carolina state law requires that properties be appraised at least every eight years. Revaluation is staggered by county such that 26 counties were revalued in 2019 and 11 counties will be revalued in 2020.11 Over the past five years, average home values rose by about 5.5 percent12 and decreased in only one county.13 All else equal, when property values increase, rates can fall and still generate the same amount of revenue. But when property values decline, rates must be raised to keep revenue constant.

What is property tax relief and why does North Carolina need it?

Property taxes are regressive because housing costs account for a much larger portion of monthly earnings for a low-income homeowner than they do for wealthier homeowners. Unlike income taxes, property taxes are based on the assessed value of the home, which means that an unexpected shock like getting laid off from work could make an otherwise manageable property tax bill unaffordable, increasing the risk of foreclosure. Relief programs allow eligible homeowners to reduce the amount they pay in property taxes each year, with the goal of helping people prevent default and stay in their homes.

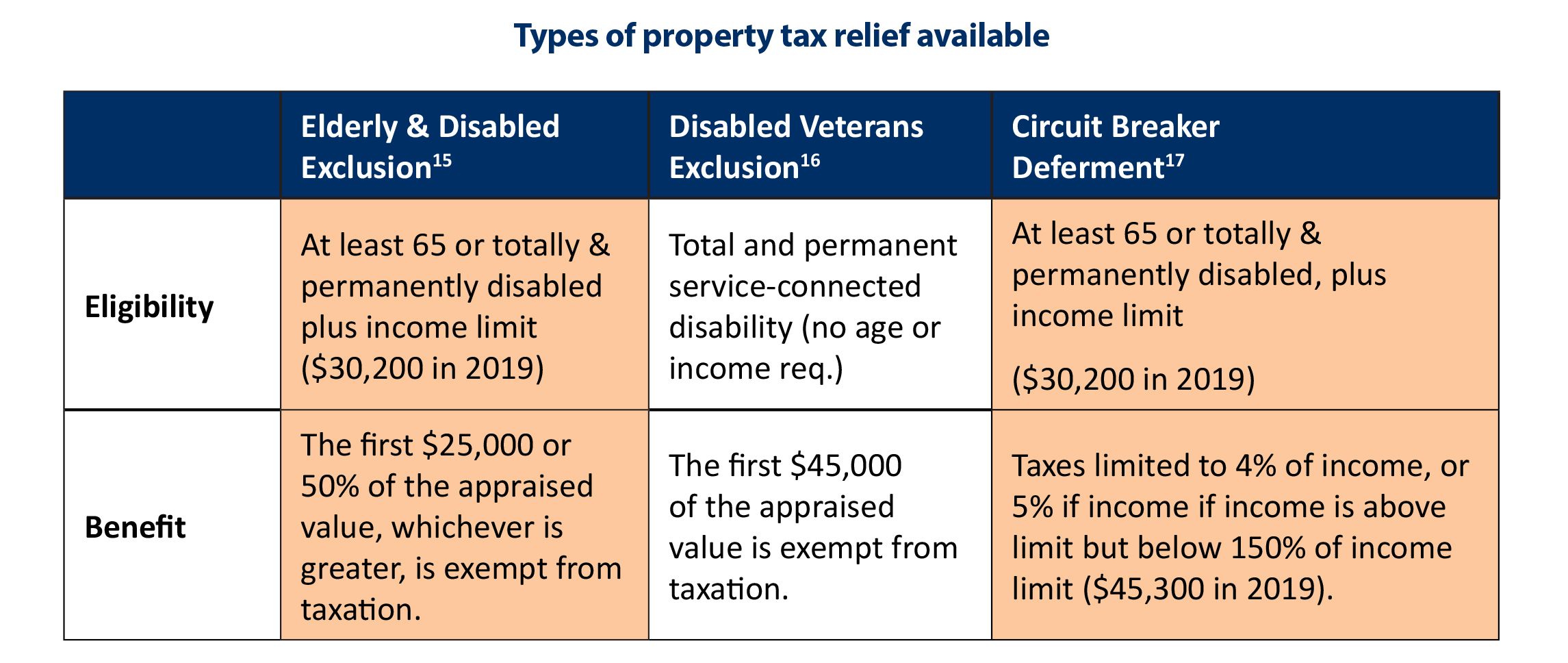

In North Carolina, there are three types of property tax relief that local governments can offer to property owners: elderly and disabled exclusion, disabled veteran exclusion, and circuit breaker deferment.14

How can North Carolina improve property tax relief programs?

There are more than 200 state and local property tax relief programs throughout the country.18 According to research, assessment limits and homestead exemptions are inefficient and create significant unintended consequences,19 while circuit breakers more effectively target aid to those who need it.20 The greatest barriers to participation in North Carolina’s circuit breaker program are eligibility, access to the application, and the deferment clause, which states that when the property transfers ownerships, three years of back taxes are owed. This is a serious deterrent to people who would otherwise participate in the program but do not want to burden future owners with debt.

North Carolina’s property tax relief programs have not been updated in decades. Every year, counties forgo taxing billions of dollars to provide property tax relief to eligible homeowners.21 The state has an obligation to ensure that these programs are worth the cost to local governments and effectively increase housing security for our state’s most vulnerable families.

Increased housing security benefits everyone. Unfortunately, rising property tax bills can displace families who have spent generations investing in their community. Displacement can fuel tensions between communities and widening economic inequality can slow productivity and growth.22 Reducing the number of foreclosures helps stabilize neighborhoods and stimulate the economy. If we want to ensure that no one is driven to foreclosure because they can’t afford increasing property taxes and that local governments have enough revenue to provide critical services, we need to re-evaluate how property tax relief programs are administered in North Carolina.

Footnotes

- North Carolina Department of Revenue. How To Calculate A Tax Bill. https://www.ncdor.gov/taxes/north-carolinas-property-tax-system/how-calculate-tax-bill.

- Hemby Bridge does not levy any property tax.

- North Carolina Department of Revenue. 2019. County and Municipal Tax Rates. https://www.ncdor.gov/documents/2018-2019-county-and-municipal-tax-rates-and-effective-tax-rates.

- Institute on Taxation and Economic Policy. How Property Taxes Work. https://itep.org/wp-content/uploads/pb46proptax.pdf.

- These scenarios use aggregate data, do not include municipal property tax rates, and are meant to demonstrate that as incomes fall property taxes account for a larger share of a family’s budget.

- American Community Survey. Table S1901.

- Zillow Home Value Index. Values as of Dec 2017. https://www.zillow.com/nc/home-values/.

- North Carolina Department of Revenue. 2019. https://www.ncdor.gov/documents/county-property-tax-rates-last-five-years.

- SmartAsset. North Carolina Property Tax Calculator. https://smartasset.com/taxes/north-carolina-property-tax-calculator.

- North Carolina Department of Revenue. County Property Tax Rates for the Last Five Years. https://www.ncdor.gov/documents/county-property-tax-rates-last-five-years.

- North Carolina Department of Revenue. County Property Tax Rates and Revaluation Schedules. https://www.ncdor.gov/documents/fiscal-year-2019-2020.

- Zillow Home Value Index. https://www.zillow.com/nc/home-values/.

- Home values in Perquimans declined by .8 percent.

- North Carolina Department of Revenue. 2019. Application for Property Tax Relief. https://files.nc.gov/ncdor/documents/files/av-9-2019.pdf.

- North Carolina General Statute 105-277.1 https://www.ncleg.gov/enactedlegislation/statutes/pdf/bysection/chapter_105/gs_105-277.1.pdf.

- North Carolina General Statute 105-277.1C https://www.ncleg.gov/enactedlegislation/statutes/pdf/bysection/chapter_105/gs_105-277.1c.pdf.

- North Carolina General Statute 105-277.1B https://www.ncleg.gov/enactedlegislation/statutes/pdf/bysection/chapter_105/gs_105-277.1b.pdf.

- Lincoln Institute of Land Policy. 2012. Residential Property Tax Relief Programs, Summary Table on Exemptions and Credits. https://www.lincolninst.edu/research-data/data-toolkits/significant-features-property-tax/resources#ResidentialPropertyTaxReliefPrograms

- Boldt, Rebecca et al. 2010. Are Property Taxes Forcing the Elderly Out of their Homes? https://www.lincolninst.edu/sites/default/files/1807_1036_Reschovsky%2520Final.pdf

- Kenyon, Daphne et al. 2010. Property Tax Relief: The Case for Circuit Breakers. https://www.lincolninst.edu/sites/default/files/1772_991_3%2520Circuit%2520Breakers.pdf

- North Carolina Department of Revenue. 2000-2017. Data Request: Value of Property Tax Relief by County.

- Boushey, Heather. 2019. Unbound: How Inequality Constricts Our Economy and What We Can Do About It. https://www.hup.harvard.edu/catalog.php?isbn=9780674919310.

Justice Circle

Justice Circle