What do Asheville, Charlotte, High Point, Winston-Salem, Greensboro, Raleigh, and Durham have in common? Other than being larger cities in North Carolina, less than you might think when it comes things like housing, equity and economy.

The Federal Reserve Bank of Chicago’s Community Development and Policy Studies division released the Peer City Identification Tool (PCIT) as a resource that draws on city level indicators from the American Community Survey and the Decennial Census. The tool then employs cluster analysis to categorize groups of cities with similarities around economic, social, demographic and housing factors.

The PCIT groups cities around four key themes to allow the user to explore a variety of potential peer communities: equity, resilience, outlook and housing. These themes were created using interviews with city leaders nationwide that informed the methodology of other place-based research that served as a model for this tool.

Equity: Equity illuminates the challenges surrounding inclusion, access, and diversity using the wage-based Gini coefficient, race and ethnicity-based dissimilarity indices, changes in poverty levels, and educational attainment.

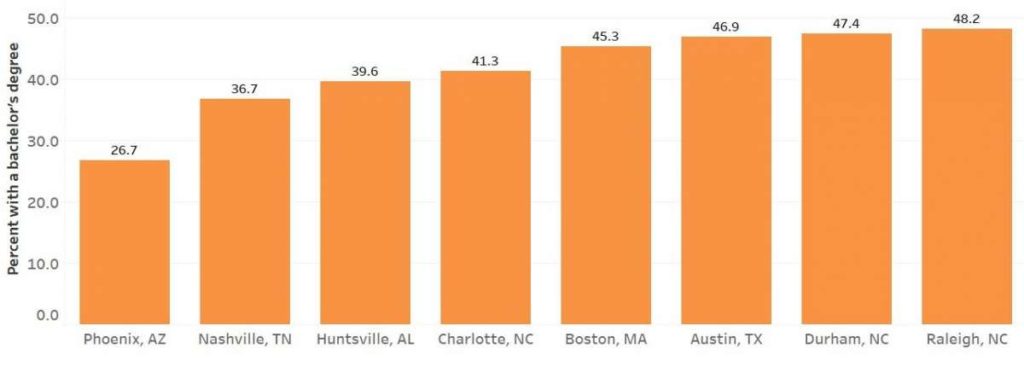

Raleigh and Durham have demonstrated themselves to be national leaders in terms of demographic equity, diversity, and growth. Raleigh and Durham’s peer cities include Austin, Boston, and Charlotte. Both Triangle cities have rates of bachelor degree holders in the high 40s,large non-white populations, and poverty rates at lower than the national average of 13.5 percent.

Resilience: Resilience examines issues related to local economic diversification. This is achieved by evaluating current conditions and trends in unemployment, manufacturing employment, and labor force participation.

On the surface, the Greensboro economy appears resilient and primed to expand in the next decade. Buoyed by innovation and energy from a number of local universities and industries like HondaJet, experts argue that the metro area has a relatively bright future. However, the data tell a different story. Peer cities include Columbus, Kalamazoo, and Evansville, and this group is experiencing a departure from their manufacturing labor base, as well as plummeting median family incomes. Greensboro itself has witnessed a 23 percent decline in its median household income from 2000 to 2015, accompanied by a 4.4 percent decline in its labor force participation rate, amongst the highest in its peer group.

Outlook: The Outlook theme analyzes indicators of a city’s demographic and economic future by integrating immigration, family composition, age structure and changes in total population.

Charlotte is a jewel in North Carolina’s urban belt and the South. Its economy, sports teams, cultural offerings and accessibility make it a destination for many. Its outlook on the surface would be bright to most, but how does that translate for all of its citizens? According to statistics, Charlotte joins an enviable group of cities like Austin, Durham, Orlando and Raleigh. Nearly 16 percent of the Queen City’s populace is foreign born, it has enjoyed a 46 percent change in population from 2000 to 2015, and 54 percent of its households have children.

Housing: Housing addresses issues of affordability by exploring data related to home ownership (income-to-home value ratio and homeownership rate) and renting (rent burden) and other related measures.

Nestled along the Blue Ridge Parkway, the French Broad River and Interstate 40 Asheville’s amenities make its real estate extremely covetous. Thusly, it is fair to ask on behalf of low income residents how issues of housing complicate their livelihood. Peer cities include Charleston, Greensboro, High Point, Lubbock, Nashville and Newport News. The percentage of Asheville renters whose rent exceeds 30 percent of their income is 42 percent, which surprisingly makes it the lowest of the peer list. Homeownership stands at nearly 51 percent, the vacancy rate is 10.5 percent, and the home value to income ratio is 4.3.

Justice Circle

Justice Circle