For people who get most of their wealth from stock equity, it has been a very good financial year. In turn, massive stock market gains in the middle of a global pandemic have widened inequality along both wealth and racial lines.

Although the effects of the COVID-19 pandemic on job loss and wage fluctuation have been felt personally by many North Carolinians, the pandemic’s effect on company stock ownership may be less obvious to the average resident. This is largely because those in the top 1 percent of the wealth index own more than half of all corporate equity and mutual fund shares in the United States, whereas the bottom 50 percent own less than 1 percent. Despite this, changes in share value during 2020 have had a significant impact on economic inequality.

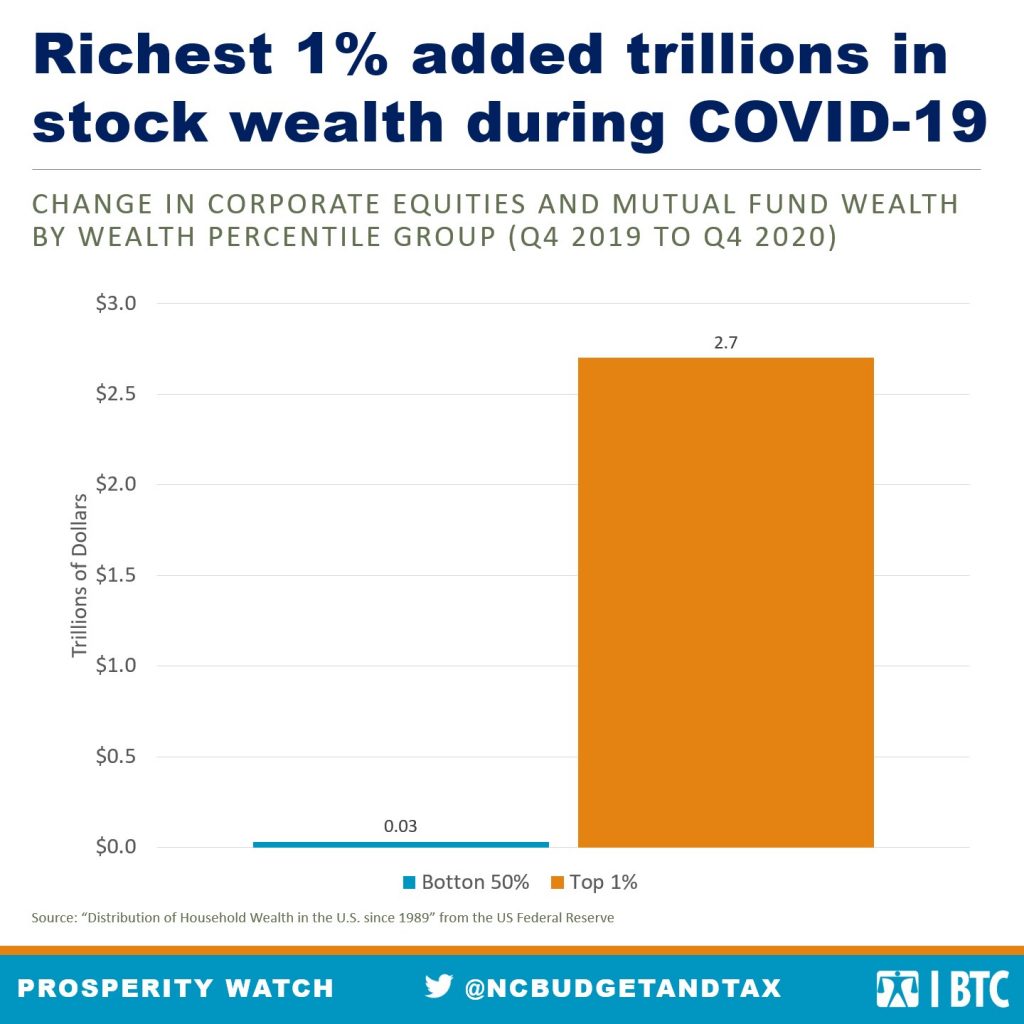

Stock and mutual fund wealth fell off by roughly 23 percent during the first quarter of 2020 when the stock market was first feeling the effects of COVID-19. However, by the end of 2020, equity ownership had not only returned to pre-pandemic levels, it had also surpassed them by over 17 percent. In the last fiscal quarter before the pandemic (Q4:2019), the top 1 percent held $15.10 trillion in stock and mutual funds, which had ballooned to nearly $17.8 trillion by the end of 2020. Last year, the richest 1 percent in the U.S. acquired $2.7 trillion in stock and mutual fund wealth while the poorest half of Americans saw less than $0.03 trillion in this kind of equity wealth growth. A typical household in the top 1 percent amassed around 4,500 times more new wealth in stock and mutual fund growth during 2020 than the average household in the bottom 50 percent.

Barriers to access to stock ownership mean COVID-19 also widened the racial disparity in equity wealth. Black people own only 1 percent of corporate equity and mutual fund shares, while an overwhelming 89 percent of shares are owned by white people. As a result, the growth of the stock market over the last year has exacerbated the pre-existing economic inequality between Black and white workers, further concentrating wealth in a small number of rich bank accounts.

Justice Circle

Justice Circle