Prosperity Watch (Issue 93, No 3)

October 23, 2018

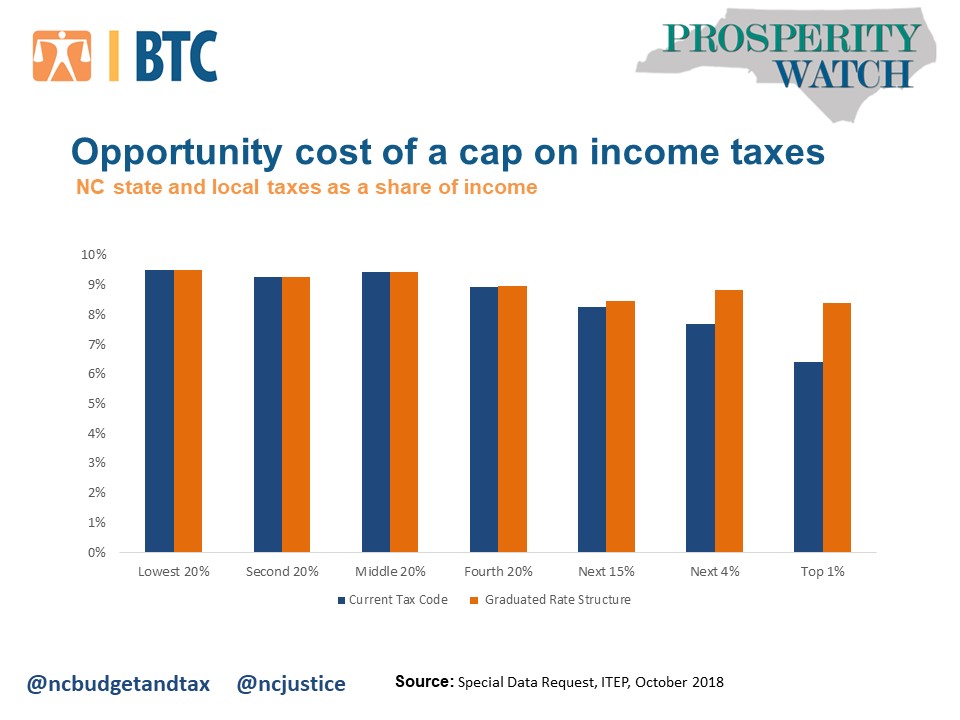

Last week, the Institute on Taxation and Economic Policy (ITEP) released an updatedWho Pays report which analyzes the current tax system—all major state and local taxes, personal and corporate income taxes, property taxes, sales and other excise taxes–in all 50 states. According to the report, North Carolina is one of 45 states with a regressive tax system. As a percentage of their income, the top 1 percent of North Carolinians[1] pay 6.4 percent in taxes, whereas the lowest 20 percent pays 9.5 percent.

This November, North Carolina voters will cast their ballot for or against a proposed change to the current maximum allowable income tax rate in the state—the most progressive source of revenue available to policymakers compared to property, sales, and excise taxes. Today, individuals pay a flat 5.499 percent on taxable income; this rate will drop further in January 2019 to 5.25 percent. The proposed change would lower that maximum allowable rate from 10 to 7 percent.

In the past, North Carolina has utilized a graduated income tax rate to help increase needed state revenue, and fund voter priorities like public education, health care and community economic development efforts. Under this graduated income tax structure, higher rates were applied to the two top income brackets—a 7.75 percent rate on income overall $100,000 (representing the income level of the top 20 percent of taxpayers) and an 8.25 percent rate on income over $200,000 (representing roughly the income level of the top 5 percent of taxpayers).

Given the data on who pays taxes in North Carolina under the current tax code, we analyzed what the incidence of state and local taxes paid across the income distribution would look like if North Carolina was able to implement these top tax brackets on higher incomes. Under the current tax code, the top 1 percent pays 33 percent less in total taxes as a percentage of income than the lowest 20 percent. When a 7.75 and an 8.25 percent rate is applied to income over $100,000 and $220,000 respectively, the difference is 11.6 percent (see Figure below). Moreover, the result is a tax code that ensures those with higher income are not receiving an additional boost to their incomes through a lower effective tax rate.

[1] Non-elderly tax payers

Justice Circle

Justice Circle